On September 27, Exicure announced plans to restructure the company and integrate resources to continue exploring strategic alternatives to maximize shareholder value. Exicure will cut about 66% of its workforce, which is expected to be completed in the fourth quarter of 2022. Exicure will also cease all research and development activities, including suspending all collaborative projects.

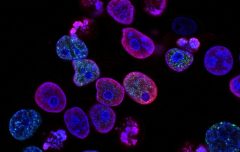

Exicure is committed to developing its unique spherical nucleic acid nanotechnology. Using a man-made nanosphere as a scaffold, researchers can load single- or double-stranded nucleic acid on the surface of the nanosphere to form a “third form” of nucleic acid. In this state, nucleic acids can enter cells without triggering the immune system. Therefore, this technology has broad application in RNAi and antisense RNA therapy.

In 2016, Exicure completed a financing totaling 42 million US dollars, and the investors included many senior investors and technology industry leaders including Bill Gates.

Exicure said the company was already in crisis when founding CEO David Giljohann left and cut half of its staff. In response to this situation, Exicure has developed a plan to focus its resources on targeting SCN9A for therapy by closing two pipeline programs – the immuno-oncology drug cavrotolimod and a preclinical drug for Friedrich’s ataxia Both deals for neuropathic pain preclinical programs and collaborations with Ipsen and AbbVie are based on Exicure’s specialty oligonucleotide technology.

However, the results of a recent in vivo study in non-human primates did not reach the expected levels observed in previous in vitro preclinical studies. Based on this, Exicure suspends further preclinical activities of the SCN9A program, while suspending all collaborative projects.

At the same time, Exicure also announced that, subject to the satisfaction of certain closing conditions, existing investor CBI Corporation will purchase a total of 3,400,000 shares of common stock at a purchase price of a total of $5.4 million, which will result in CBI having a de facto controlling interest in Exicure.