ADC (antibody-drug conjugate) has become one of the research hotspots in the field of oncology in recent years. At the 2022 American Society of Clinical Oncology (ASCO) annual meeting, pharmaceutical companies successively demonstrated the research results of ADC drugs; on the other hand, Merck also recently reported that it intends to acquire Seagen, the leading ADC company, to accelerate the layout of the ADC market.

In fact, with the continuous disclosure of the clinical research results of ADC drugs in recent years, the number of companies entering this market has continued to increase, and the “Internet celebrity” product of ADC has attracted widespread attention. In recent years, a number of ADC drugs have been approved for marketing, and the market scale has grown rapidly. Since 2019, a total of 9 ADC drugs have been launched in the world, more than the sum of the previous nearly two decades. In 2021, the global ADC drug sales will exceed US$5 billion, with an average compound growth rate of about 30% from 2014 to 2021.

This is mainly based on the fact that ADCs have more controllable toxicity than chemotherapy drugs, and the new generation of ADCs have achieved clinical treatment data that are significantly better than those of chemotherapy. Compared with traditional targeted therapy, ADC further broadens the treatment population: for new targets not covered by traditional targeted therapy; for old targets, for patients who do not respond to traditional targeted therapy; for old targets, Expand the patient population with low target protein expression.

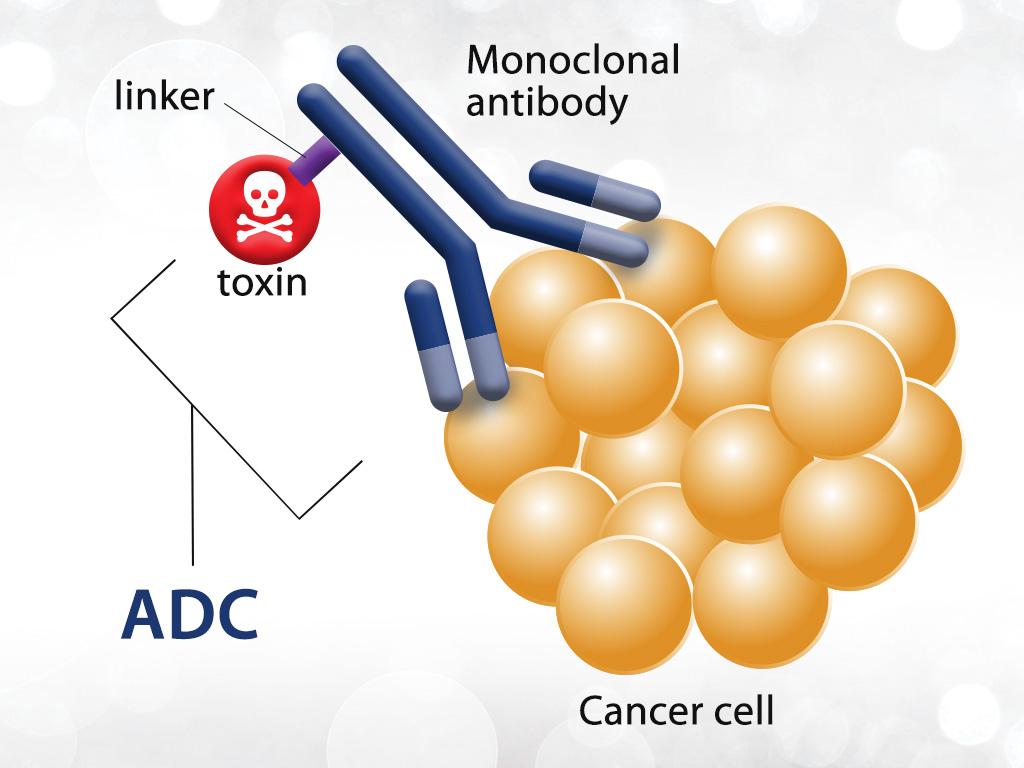

The reason why ADC drugs have attracted so much attention is also because these drugs do have relatively good curative effects. From the perspective of the mechanism of action of the drug, it is more specific. Because the drug carried by the antibody is more targeted and carries cytotoxic drugs, this toxin is often more cytotoxic and has efficient killing, such as DS-8201, Such drugs are targeted to tumor cells, and also have a bystander effect, with good efficacy and good safety, so they are particularly expected in clinical practice.

Now many pharmaceutical companies are developing ADC drugs, and they should not be too blind. The drug research and development of ADC has developed to the third generation, and dual-targeted ADCs have appeared, and they do have some differences in efficacy and safety. We especially hope that there will be drugs with better efficacy and higher safety on the market.

Competition in the ADC drug market heats up

Since the first launch of Pfizer’s ADC drug Mylotarg in 2000, ADC drugs have also become a hot track for new drug development.

Up to now, 13 ADC drugs have been launched in the world, of which 3 ADC drugs have been launched into the market in the 16 years from 2000 to 2016, and a total of 10 ADC drugs have been launched into the market in the past five years. From the perspective of the R&D pipelines of domestic and foreign companies, ADC drugs have become the key direction of the global innovative pharmaceutical companies, and may usher in a new peak in 3-5 years. From the perspective of indications and target distribution, tumors are the core direction of focus at present, but the focus has shifted from hematological tumors to solid tumors. HER2 is still a popular target, but the exploration of new targets is also increasingly diversified.

In 2021, the global ADC sales will be nearly 5 billion US dollars, and the compound annual growth rate from 2014 to 2021 will be about 30%. Adcetris was approved in 2011 and has global sales of approximately $1.27 billion in 2021. Kadcyla was approved in 2013 and has global sales of approximately $2.13 billion in 2021. The future growth potential of the new generation of ADC drugs is huge. Enhertu and Padcev were both approved by the FDA in 2019, with sales of 500 million and 340 million US dollars respectively in 2021. Nature predicts that the sales of the above two drugs will reach 6.2 billion in 2026. dollars and $3.5 billion.

According to statistics from industry organizations, there are currently more than 400 ADC drugs under research in the world, of which more than 200 have entered the clinical stage. There are more than 170 ADC drugs under research in China, of which nearly 60 have entered the clinical stage.

With the continuous iteration of antibody conjugation technology, more and more potentials of ADC drugs are being tapped. There are still considerable opportunities for exploration in this area of ADCs:

One is that ADCs are very good mechanisms, and antibodies linked to chemotherapeutics can bring together two classic, years-proven tumor solutions. But in different tumor disease fields, the biological properties of its target may be different. Some are protein expression levels, some are gene mutation levels, and some are gene proliferation levels. Therefore, we need to conduct more exploration and research on the biological characteristics of different diseases and targets.

Second, when the disease progresses, how should the drug resistance problem be solved? ADC combination therapy is a very important therapeutic strategy. For example, ADCs are connected to small molecules and immunotherapy. We need to explore these aspects in the future.

Third, dual-target bispecific antibodies are considered to be a major trend. A tumor cell may have different targets. In the future, how to combine the driver genes with different targets can be combined with chemotherapy drugs to produce a greater effect. That is, how to promote the development of dual-target ADC research may also be a trend in the future.